What Is The Retirement Age In Australia

Last Updated on 4 February 2024 by Ryan Oldnall

Australia has no specific age for when a person must retire. Often when Australians discuss their retirement it is done from the perspective of when they are eligible to draw the Australian age pension.

Currently, the age eligibility for the Australian age pension is 67 years old. This has very recently increased from 66.5 years beginning from 1 July 2023.

So, What Is The Retirement Age In Australia? With no specific retirement age, Australians could theoretically retire well before they turn 67 or even into their 70’s. For various reasons, this may not always be practical on both sides of the coin.

So, We will explore in this article further the factors which influence a person’s retirement and the level of financial freedom they may enjoy.

Retirement Planning In Australia and the Aged Pension

Retirement planning is a very broad and complex topic with many considerations depending on your marital status, age, and income levels. savings, investments, and health status, and if you own your family home.

All these factors combined play a huge significance when planning for one’s retirement.

As an individual edges towards both their retirement and preservation age, a number of things change. Often their investments whether that be in Super or share investments will change to become more defensive.

When it comes to the specific timing of these changes, it is advisable for individuals to engage in discussions with a financial advisor or explore options with their super fund provider.

Super funds offer a Super Lifecycle investment option, which automatically adapts and balances an individual’s asset allocation according to their age.

This option ensures that the investment strategy aligns with the appropriate life stage of the person.

Consequently, as individuals progress in age, their superannuation fund will gradually transition their portfolio from growth assets like domestic and international shares to defensive assets such as cash or fixed-interest investments.

Retirement Considerations

Planning for retirement varies significantly between individuals in different age groups. The approach taken by a 20-30 year old differs greatly from someone who has reached their preservation age.

As a result, each person’s circumstances are unique and require a highly individualized approach.

However, it is possible to make generalizations about the steps an individual may take when planning for retirement.

Being in a long-term relationship or marriage has a significant impact on retirement planning. When both partners have their own sources of income and are similar in age and health status, they can develop a retirement strategy that reflects their current circumstances.

Since both individuals are earning incomes, it is probable that they are both making contributions to their superannuation funds over an extended period. In a recent article, I provided insights on selecting an appropriate superannuation fund.

Within the same article, I also emphasized the importance of determining the necessary retirement savings based on projected annual expenses. The article referred to data from Super Consumers Retirement, which shed light on the frequently discussed benchmark of a $1,000,000 super fund balance.

According to this data, a couple who owns their own home would ideally aim for a super balance of $1,000,003 by the time they reach the age of 65, in addition to potential entitlements from the aged pension.

Reaching this balance would allow individuals to draw upon $81,000 per year in retirement, equivalent to a fortnightly amount of $3,115.

This amount represents the higher end of the spectrum, with a minimum balance of $402,000 required by age 65 to sustain a fortnightly spend of $2,462 or an annual amount of $64,000.

An important element contributing to this calculation was the complete ownership of their primary residence. This factor holds a significant influence since it implies that the individual is not burdened with mortgage repayments or the need to account for future rental increases.

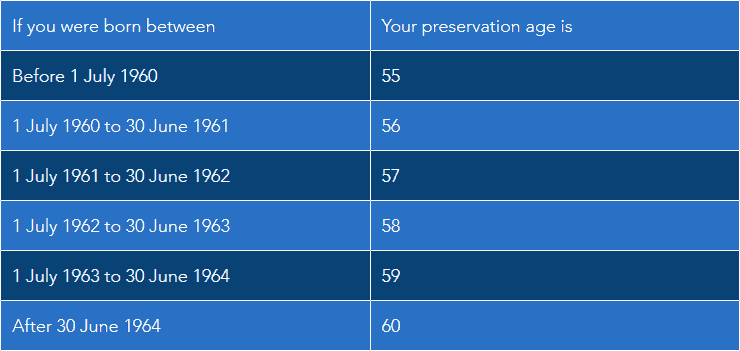

What Is The Preservation Age In Australia

The preservation age in Australia is not widely known and is commonly misunderstood. The Australia preservation age is essentially the age at which a person can do things such as their superannuation.

It is referred to as the preservation age as the Commonwealth dictates that the funds in your super fund are preserved until you meet the conditional requirements of its release.

These super laws prevent an individual from accessing their super until the individual meets the following 3 criteria as outlined on the ATO Website:

- Reach their preservation age and retire

- Reach your preservation age and choose to begin a transition to a retirement income stream while you are still working

- Are 65 years old (even if you have not retired).

As per the above, you can start accessing your super when you reach age 65. If you are under age of 65, you can also access your super if you reach your preservation age and have retired from the workforce.

There have been instances where the Commonwealth have allowed individuals to access their super funds well before reaching their preservation age.

This was done most recently during the Covid pandemic when the Government allowed individuals to access lump sums under strict circumstances.

Australian Aged Pension

The age an individual becomes eligible to receive the aged care pension is often misquoted as the age of retirement. This is because for some this would be their only source of income and therefore they would be unable to retire before this time.

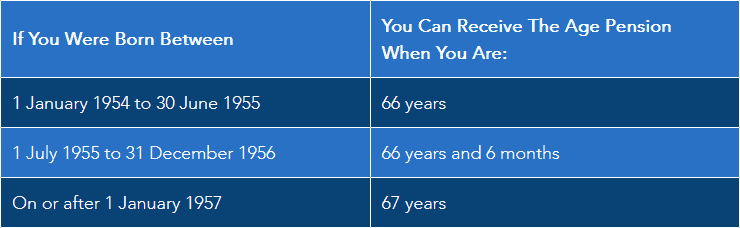

The retirement age and eligibility for the aged pension in Australia are determined based on an individual’s birth year. As indicated in the following table, the current pension age is 67, which was recently raised from 66 and 6 months.

Aged Pension Eligibility

The Age Pension you receive is determined by the income you earn from various sources like employment, superannuation, or investments. Additionally, the income of your partner also impacts the amount of Age Pension you’re eligible for.

When calculating your Age Pension, Centrelink considers the combined income of both you and your partner. You are both able to earn a certain amount of income from employment each fortnight before your Age Pension payment is reduced.

For an individual to receive the Australian Age Pension they must meet the Government’s income and assets test discussed below. The current maximum fortnightly Aged Pension is $1,064 for a single and $1,604 for a combined couple.

These rates include both the maximum pension supplement and energy supplement available.

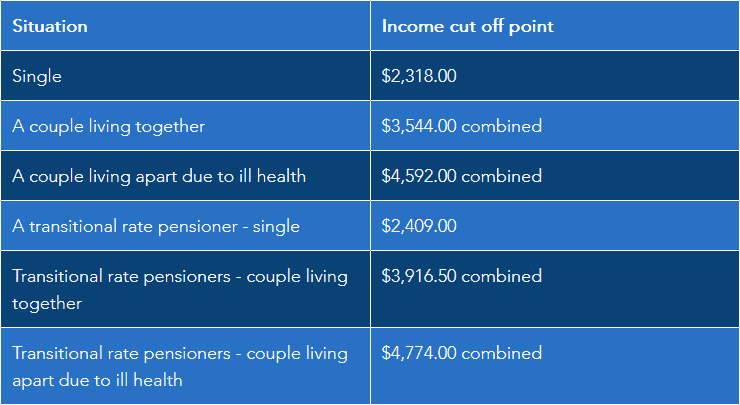

Australian Age Pension Income Test

Services Australia provides income cut off points per fortnight before an individual’s age pension is reduced. This means that under these income tests a single person can earn $2,318 in taxable income before their pension is reduced, with a co-living couple earning $3,544 jointly.

Source: ATO Income Test for Pensions.

*According to Services Australia the transitional rate of pension began in 2009 and it is for pensioners who would get a lower pension under the new income test.

Australian Age Pension Assets Test

During the assessment of an individual’s assets by the Australian Government, all types of assets are taken into account. The Government maintains an extensive list of assets that are subject to assessment, along with their corresponding definitions.

When it comes to investments such as the stock market, the Government automatically updates their values twice a year. As a result, individuals are not required to report value changes caused by the natural fluctuations of the stock market.

The value of your assets, including properties, bank accounts, investments, and retirement funds, also affects the amount of Age Pension you receive. However, your primary residence is excluded from this assessment.

It’s important to be aware that transferring or gifting your assets may have consequences for your Age Pension eligibility.

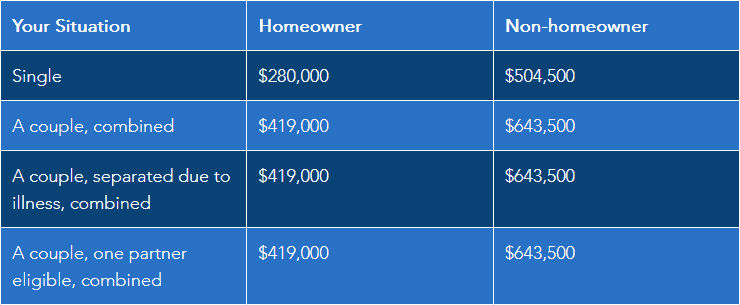

Full Pension – Asset Test

If an individual or couple exceed the listed amounts below, their pension will reduce. The listed figures for a couple are their combined joint value, not per individual.

Source: Aged Pension Assets Test

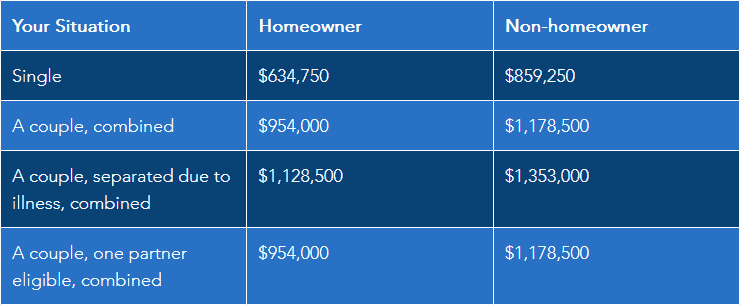

Part Pension – Asset Test

Commencing on the 20th of March 2023, the Australian Government ceases to provide part pensions to individuals who exceed the specified asset thresholds.

Source: Aged Pension Assets Test

What Is A Self-Funded Retiree?

In Australia, a self-funded retiree is an individual or couple who relies on their own savings, investments, and superannuation to support their retirement lifestyle.

Through retirement planning, these individuals do not rely upon the aged pension as a source of income.

A self-funded retiree refers to someone who exceeds the eligibility criteria for a part pensioner. These individuals have income and assets that surpass the predefined thresholds set by the government.

As a result, they do not qualify for the aged pension because their financial situation falls outside the established thresholds.

Summary

Retirement planning in Australia can be a complex process influenced by numerous factors. Individuals must consider their unique circumstances and seek professional advice to make informed decisions where required.

Understanding the preservation age, eligibility for the aged pension, income, and assets tests, and the concept of self-funded retirement is crucial for planning a financially secure retirement.

It is crucial to start considering retirement goals early on. Although these goals may change as time goes by, initiating the planning process at an early stage enables individuals to understand the amount of savings they must accumulate over their lifetime to realize their desired retirement lifestyle.

By taking proactive steps, individuals can enhance their preparation for a retirement that is both comfortable and fulfilling.