Investing in Tesla Shares 2023

Last Updated on 27 January 2024 by Ryan Oldnall

Tesla is one of the world’s largest electric car manufacturers. Spearheaded by its founder and CEO Elon Musk, Tesla have been a global hit in the electronic car market.

Tesla’s share price (TSLA) has grown significantly with year-to-date (YTD) growth of 140.54%, which is nearly 4 times the growth of the NASDAQ (IXIC) which has grown at a respectable 35.66% (At the time of writing)

Is investing in Tesla Shares still an attractive proposition?

Tesla in Numbers

Following the release of its second-quarter earnings, Tesla encountered a 10% decline in its stock price. The company closed the day at $262.90, despite the initial impression of a positive earnings report.

While Tesla achieved record-breaking quarterly revenue figures, the company’s overall vehicle profit margins have been impacted due to recent discounting measures.

In multiple countries like Germany, the US, China, and Australia, Tesla has implemented price reductions across its vehicle range. Despite facing increasing inflation rates, Tesla has continued to offer these series of discounts on its vehicles.

On the back of reduced consumer spending, people do not have the same levels of disposable income which was experienced in Covid times thanks to the record low mortgage interest rates.

Thus, Tesla has been trying to entice potential buyers with lower vehicle costs.

A base spec Tesla Model 3 Sedan in Australia is now AUD 57,400 plus on-road costs. In March 2022 the same car cost $59,900 plus on-road costs.

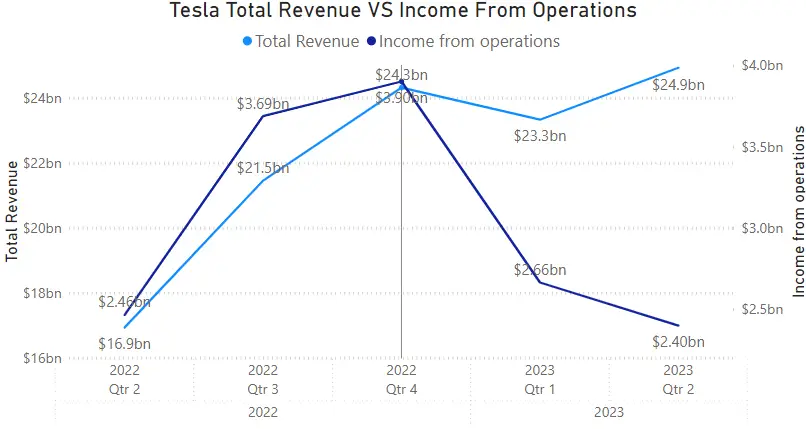

According to the Tesla Q2 2023 Update, Tesla’s Total Revenue increased to $24.9 billion, with year-on-year growth of 47%. However, the income from operations declined from a high of $3.9 billion in Quarter 4, 2022 to 2.4 billion in Quarter 2, 2023.

Data Source: Tesla Q2 2023 Update

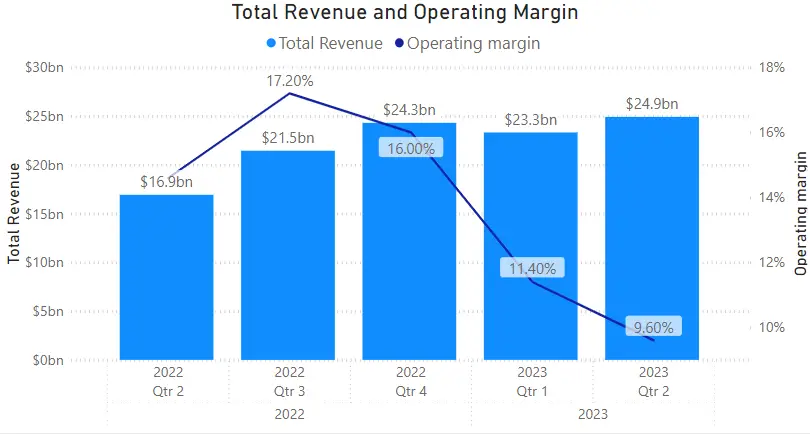

Tesla’s Operating Margin has been gradually from the end of Quarter 3, 2022 to Quarter 2, 2023. In Quarter 3, 2023 Tesla reached a peak of 17.20% operating margin with total revenue of $21.5 billion.

This operating margin has since declined to 9.60% representing a year-on-year according to Tesla figures of -493 bp.

Data Source: Tesla Q2 2023 Update

The value proposition of Tesla in the current economic climate is yet to be determined. With persistent worries about a global recession and ongoing inflation challenges in many countries, it is reasonable to anticipate fluctuations in Tesla’s share price, as has been the case for many years.

Being a cyclical stock, Tesla is not immune to these influencing factors.

How To Buy Tesla Stocks in Australia?

If you are looking to invest in Tesla Stocks in Australia, I cover this subject matter in great detail in my article: How to Buy Tesla (TSLA) Shares in Australia.

This article goes into depth regarding the ins and outs of buying Tesla Shares and the considerations you need to think of when buying US-listed stocks.