iShares Core S&P 500 ETF (IVV) Sector Allocation

Last Updated on 27 January 2024 by Ryan Oldnall

The objective of iShares Core S&P 500 ETF (IVV), is to offer investors the performance of the S&P 500 Index, excluding fees and expenses. This ETF is specifically designed to track the performance of large-cap US equities.

IVV is a cost-effective ETF that provides international diversification. Many of the companies within the S&P 500, although listed in the US, have a global presence, and are widely recognized. These companies employ individuals worldwide and have offices in major countries.

The Australian version of IVV, directly invests in the US-listed IVV, which allows Australian investors to gain direct exposure to the US and international markets without facing tax implications.

This is a considerable advantage for Australian investors seeking access to these markets. To get a better understanding of how to invest in US listed stocks, read these articles of investing in technology powerhouses Tesla and ,NVIDIA.

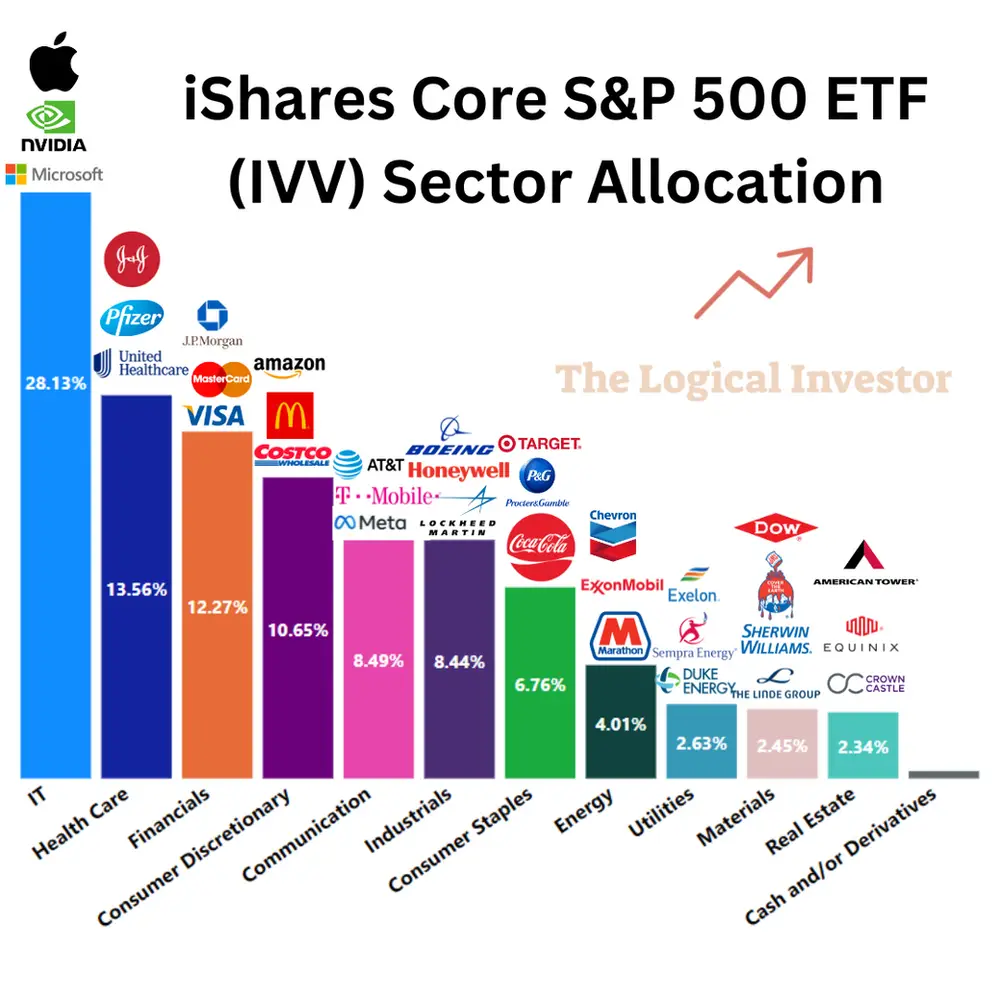

Sector Allocation of IVV

Similar to other US and Australian ETFs that directly invest in the US or international markets, IVV is heavily weighted towards IT and technology stocks. Information and technology-related shares, including well-known companies like NVIDIA, Apple, and Microsoft, constitute 28.13% of IVV’s holdings.

The ETF also has substantial investments in the healthcare sector, with Johnson & Johnson, Pfizer, and United Healthcare among its major holdings.

IVV Top 10 Holdings

According to Morningstar Top 10 Holdings of IVV, more than 60% of the companies in IVV currently have a wide MOAT (competitive advantage), while 30% have a narrow MOAT, and less than 10% have no MOAT at all. The top 10 holdings make up 30% of IVV’s portfolio.

IVV has demonstrated impressive growth, with the ASX-listed ETF delivering a 15-year total return of 12.47%, and the US-listed IVV achieving a return of 10.45%.

IVV is recognized as one of the prominent Australian ETFs that provides exposure to US large-cap stocks. Do you currently own IVV in your portfolio?