Dollar Cost Averaging in Australia

Last Updated on 23 January 2024 by Ryan Oldnall

What is Dollar Cost Averaging (DCA)?

The Dollar Cost Averaging (DCA) strategy is a popular investment concept that allows investors to spread their risk over a period of time. Instead of making a one-time, large lump sum investment, an investor makes incremental investments over a regular interval until the funds are fully expended.

This blog post will explore how Dollar Cost Averaging works, why it is a successful strategy, and who uses it.

Why Use Dollar Cost Averaging (DCA)?

Dollar Cost Averaging is a strategy used by both experienced and inexperienced investors to gain exposure to shares, ETFs and managed funds. ETF dollar cos averaging strategy works as it does not require the investor to time the market or “buy the dip”.

By investing a fixed amount of money at regular intervals, the investor takes the emotion out of trying to timing the market. This removes the risk of missing out on buying opportunities or making poor investment decisions based on market fluctuations.

Inherently, people want to make the ‘best’ purchase they can, so will try to get their desired ETF or shares at the lowest possible price – by doing this they are effectively trying to time the market.

The most common method of doing this is looking at the current market value and the value over the last month or 5 days and picking a number based on what they think is ‘good value’.

The risk with this is if the market has an upward trend and that buy order is never executed because the conditions are not met.

Dollar cost averaging removes all this emotion and thinking and simply makes a purchase at market rate.

How Does Dollar Cost Averaging Work?

Dollar Cost Averaging works by reducing the risk of unknowingly timing the markets at the worst possible time. When an investor makes an investment at the highest point, they will purchase fewer units or shares.

Conversely, if the market falls, the investor will purchase a greater number of shares for the same invested amount. This means that the investor will benefit from the fluctuations in the market over time, rather than trying to make a profit by timing the market.

Dollar Cost Averaging in numbers

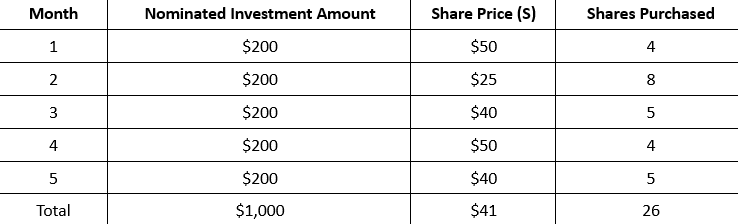

To illustrate how Dollar Cost Averaging works in practice, let’s take an example. Suppose an investor has $1000, which they have decided to invest over a 5-month period, splitting their investable amounts into $200 allocations.

In the first month, the investor entered the market at $50 a share and purchased 4 shares in total. In the second month, the share price tumbled, and the investor purchased 8 shares at $25 each.

Over the course of the 5 months, the investor purchased 26 shares with an average of $41 paid per share. If the investor had invested all their $1000 on the first purchase, they would have only purchased 20 shares at $50 each.

Superannuation Funds are a real world example of Dollar Cost Averaging

The most well-known example of Dollar Cost Averaging, particularly for Australian’s is superannuation. A significant portion of Australian’s have a superannuation fund in which their employer makes compulsory super contributions to.

These super funds then go and invest these compulsory contributions at regular intervals (usually their pay cycle) regardless of the market. This means that the funds are invested in the market regardless of its current value.

Summary

Dollar Cost Averaging is a legitimate strategy for long term investing. It relies on the notion that the market will undoubtedly change, and individuals have no sure way of predicting the market.

Therefore, Dollar Cost Averaging favours time spent in the market, than timing the market. By using Dollar Cost Averaging, investors can spread their risk over time, reduce their exposure to market volatility, and increase their chances of achieving long-term investing success.

Dollar cost averaging vs lump sum provides greater protection against fluctuations in the market, when an investor spreads their investments over a longer period.