Buying Tesla (TSLA) Shares in 2023

Last Updated on 27 January 2024 by Ryan Oldnall

Are Tesla (TSLA) Shares A Good Buy in 2023?

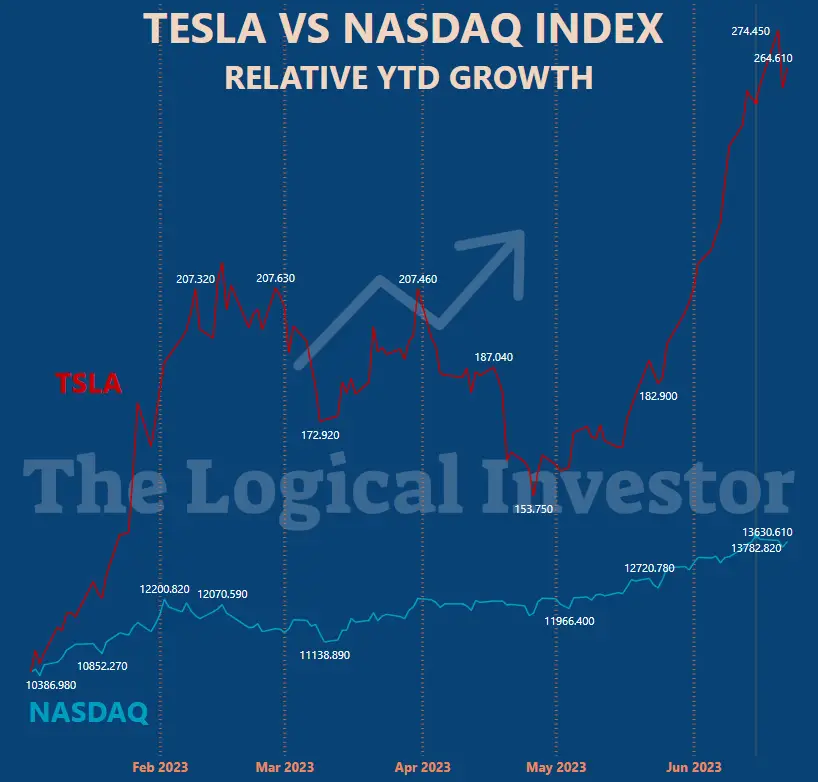

Tesla’s manufacturing has reached an all-time high, contributing to its impressive stock growth. Tesla shares (TSLA) have experienced a staggering Year-to-Date (YTD) growth of 144.78%.

Starting the year at $108.10, the stock price has soared to $264.61. This article delves into the sustainability of this growth and its implications for investors.

Tesla Stocks Tremendous Growth in 2023 Compared to Peers

When comparing Tesla’s growth in 2023 to its industry peers, it becomes evident that Tesla has outperformed many.

As a listed company on the NASDAQ under the ticker symbol TSLA, Tesla has played a significant role in driving the NASDAQ Composite Index’s respectable YTD growth rate of 31.23%. Notably, Tesla, NVIDIA, and Meta have all achieved triple-digit growth since the beginning of the year.

The NASDAQ‘s technology stocks have been the real drivers of growth in 2023 after a decline for many in 2022. Similar to Tesla, NVIDIA (NVDA) has seen its stock value surge by 195.20% YTD. If you interested in buying NVIDIA stocks read this guide on how to buy NVIDIA (NVDA) Shares.

Challenges To Tesla’s Share Price and Its Founder, Elon Musk

While Tesla’s growth has been remarkable, it is essential to acknowledge the challenges the company has encountered. Previously valued at an astonishing $409.97 on November 4th, 2021, Tesla’s stock price declined due to challenges associated with the Covid pandemic.

Similar to other global car manufacturers, Tesla encountered increased delays during the peak of the pandemic, resulting in decreased production levels and difficulties in sourcing parts. To stimulate more business, Tesla implemented a series of price reductions on some of their car models.

Furthermore, Tesla encountered setbacks when its founder, Elon Musk, publicly expressed his belief that the stock was overvalued. This statement, shared through his Twitter account, led to Tesla’s share price to plummet by 10%.

Tesla Overcoming Manufacturing Issues

Tesla has had a history of struggling with vehicle production and meeting demand. In its early days, the company faced productivity challenges and fierce competition from established brands.

However, according to Statista, Tesla’s manufacturing is at an all-time high, producing approximately 440,000 vehicles in the last quarter of 2022 and the first quarter of 2023. This increase in production has mirrored its stock price growth

Investing in Tesla Shares

If you are interested in how to buy Tesla shares in Australia, understanding the process is crucial. Purchasing Tesla shares is relatively straightforward, similar to buying Australian shares, albeit with some additional paperwork. In this article, we provide a comprehensive guide on How to Buy Tesla (TSLA) Shares in Australia.

It is crucial to recognize that investing in overseas stocks and non-Australian domiciled shares or ETFs entails additional tax implications. Therefore, it is advisable to assess the suitability of these investments for your circumstances and consult with a knowledgeable accountant.

Investing in Tesla through Australian ETFs

Australia offers several large ETFs that hold Tesla as a component. Notable examples include FANG, IVV, VGS and NDQ. Investing in these ETFs allows investors to gain exposure to Tesla (TSLA) without the complexities of additional taxes associated with direct investment in foreign-listed stocks.

Analysing the Value of Tesla Shares in 2023

Tesla’s share price has witnessed significant growth in 2023, albeit not as substantial as the surge experienced between 6/1/2020 and 1/11/2021, when it skyrocketed by 1329.26%.

It is crucial to acknowledge the controversies surrounding Tesla, mainly related to its founder, Elon Musk. With Musk’s recent acquisition of Twitter and the appointment of a new Twitter CEO, there is potential for a brighter future for Tesla.

Considering the challenges and controversies, Tesla’s stock in 2023 shows potential for ongoing growth as it strives to maintain its position as the leading electric car maker.

With Elon Musk’s recent acquisitions and the public attention surrounding Tesla, the company’s future appears promising. Stay tuned to witness how Tesla navigates the dynamic market and continues to shape the future of electric vehicles.

This article is for informational purposes only and does not constitute as an endorsement or recommendation to purchase any specific mentioned product.