Best Crypto ETFs In Australia

Last Updated on 20 February 2024 by Ryan Oldnall

For those interested in crypto trading but seeking to avoid the complexities of crypto exchanges, bitcoin wallets, and related efforts, a crypto ETF could be the solution.

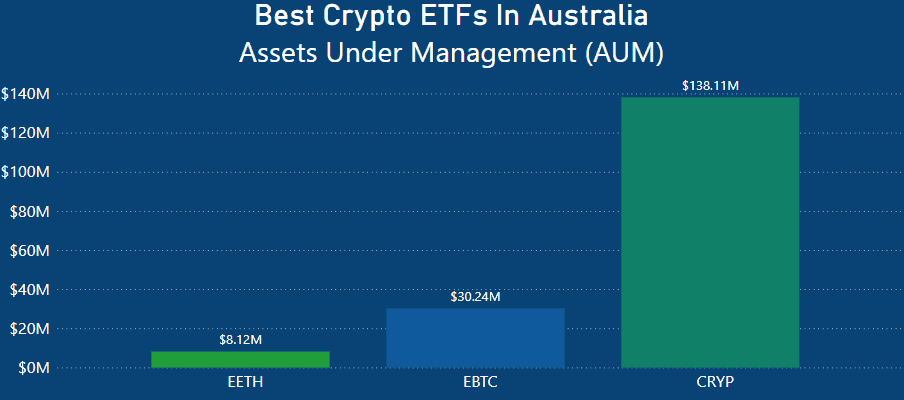

Crypto ETFs are a recent addition to the ETF market, with the popular Crypto ETF, CRYP, holding over $138 million in assets under management (AUM) [1].

This article will analyze the individual performance, holdings, management expense ratios (MER), and assets under management (AUM) of the following 3 ETFs.

-

- Betashares Crypto Innovators ETF, CRYP

- Global X 21Shares Ethereum ETF, EETH

- Global X 21Shares Bitcoin ETF, EBTC

What Is a Crypto ETF

A Crypto ETF, or Cryptocurrency ETF, is a financial product designed to expose investors to the cryptocurrency market through a diversified portfolio of digital assets.

Similar to traditional ETFs, Crypto ETFs are traded on stock exchanges, allowing investors to buy and sell shares throughout the trading day at market prices.

The ETF typically holds a basket of cryptocurrencies, aiming to track the performance of a specific cryptocurrency index or a custom index created by the fund manager.

This approach provides a more accessible and liquid way for investors to participate in the crypto market without the need to directly manage or secure individual digital assets.

Crypto ETFs are subject to regulatory oversight, and their structure must comply with the regulations of the jurisdiction in which they are offered.

For example, CRYP is the sole crypto ETF listed on the ASX, Australia’s largest securities exchange.

The other two ETFs, EETH and EBTC, are listed on Cboe Australia (CXA), the second-largest securities exchange in Australia [2].

Risks When Investing In Crypto ETFs

Investing in anything comes with risk, and that holds true for any ETF, including Betashares Diversified All Growth ETF (DHHF). DHHF itself invests in four different ETFs, providing exposure to 8,000 equities, but it still carries inherent risks.

Crypto ETFs, in particular, come with heightened risk. Unlike traditional ETFs, where value is derived from companies delivering growth and profits, the value of cryptocurrencies is more influenced by supply and demand and perceived future value.

Additionally, investing in Crypto ETFs involves inherent risks that investors should carefully consider. The significant concern is the volatility of cryptocurrency prices, known for rapid and sometimes unpredictable fluctuations.

Entering the world of cryptocurrency exchange-traded funds (Crypto ETFs) requires acknowledging their inherently elevated risk profile.

The concentrated exposure to companies deeply immersed in cryptocurrency markets underscores the need for investors to be prepared for increased volatility and fluctuations in returns. One day, your ETF could be sky-high; the next, it could be near worthless.

Speculation in Crypto-Assets: The speculative nature of crypto-assets and blockchain technology takes precedence as investors navigate uncharted territories. The unpredictable nature of underlying cryptocurrencies can change dramatically.

Volatility in Markets and Crypto-Assets: Volatility is a prevalent theme affecting both traditional financial markets and the rapidly evolving crypto-asset space.

Examining the ETF’s susceptibility to global events, economic conditions, and the inherently erratic nature of crypto-asset markets reveals the challenges associated with managing volatility.

Risks with Crypto Innovators: Companies actively involved in crypto-asset technology face a spectrum of risks, from untested applications of blockchain technology to heightened vulnerabilities in cybersecurity.

According to Investopedia, cryptocurrency exchanges (where crypto is traded) are prime targets for hackers, with over $3.8 billion stolen in 2022 alone [3].

What Are The Biggest Crypto ETFs In Australia?

The largest Crypto ETF on the Australian market is currently Betashares Crypto Innovators ETF, CRYP, managing $138.11 million in assets. This exceeds the second-largest, Global X 21Shares Bitcoin ETF, EBTC, which holds $30.24 million—more than four times less than CRYP.

Conversely, Global X 21Shares Ethereum ETF, EETH, is the smallest crypto ETF, overseeing $8.12 million worth of assets.

It’s essential to note that there were more ETFs in Australia previously. The 3iQ CoinShares Ether Feeder ETF (ET3Q) and 3iQ CoinShares Bitcoin Feeder ETF (BT3Q) were part of them. However, both have since been liquidated.

What Is The Cost Of Investing In Crypto ETFs?

It’s not surprising that investing in crypto ETFs incur higher costs compared to holding cryptocurrencies directly in a wallet. However, the convenience of buying and holding an ETF through a brokerage platform, such as CMC or Commsec, comes with its associated expenses.

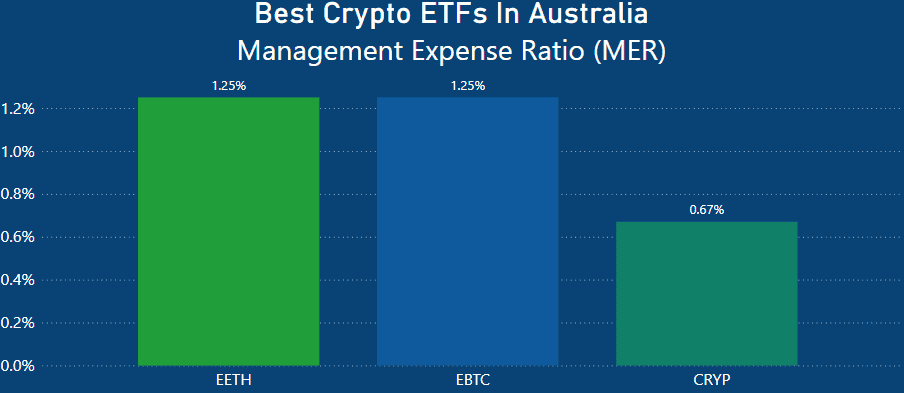

Both Global X 21Shares Ethereum ETF, EETH, and Global X 21Shares Bitcoin ETF, EBTC, stand out as the most expensive options on the Australian market, each carrying a Management Expense Ratio (MER) of 1.25%. This implies that for every $1000 held in these ETFs, investors would pay $12.50 in fees.

On the other hand, Betashares Crypto Innovators ETF, CRYP, offers a more cost-effective alternative with a MER of 0.67%, nearly half of the MER of the other Global X ETFs. This means for every $1000 invested in CRYP, investors would incur $6.70 in fees.

What Do Crypto ETFs Invest In?

BetaShares Crypto Innovators ETF (CRYP) on ASX:

The BetaShares Crypto Innovators ETF (CRYP) on the ASX is designed to provide investors with exposure to the cryptocurrency economy.

By investing in up to 50 crypto leaders, including companies like Coinbase, Riot Blockchain, and MicroStrategy, CRYP seeks to harness the potential of the ever-evolving crypto landscape.

Global X 21Shares Bitcoin ETF (EBTC) on CXA:

Listed on the CXA, the Global X 21Shares Bitcoin ETF (EBTC) aims to deliver returns closely correlated with the price of Bitcoin in Australian dollars.

This ETF prioritizes security by storing Bitcoin in ‘cold storage’ through Coinbase, the world’s largest custodian of cryptocurrencies. This adds an extra layer of protection to the digital assets held within the fund.

Global X 21Shares Ethereum ETF (EETH) on CXA:

Traded on the CXA, the Global X 21Shares Ethereum ETF (EETH) closely mirrors its Bitcoin counterpart but with a specific focus on tracking the price of Ether in Australian dollars.

Investors in EETH acquire an interest in Ether securely stored in cold storage by Coinbase, presenting a regulated pathway for investors to access Ethereum while prioritizing the security of their digital assets.

Crypto ETF Performance

When evaluating the performance of different crypto investment options, I’m going to explore three time frames: the 3-month performance, year-to-date (YTD) performance, and performance since inception.

In the case of crypto ETFs, I believe the performance since inception is crucial, as it paints a rollercoaster picture of super highs and super lows.

Crypto ETF Performance – 3 Months

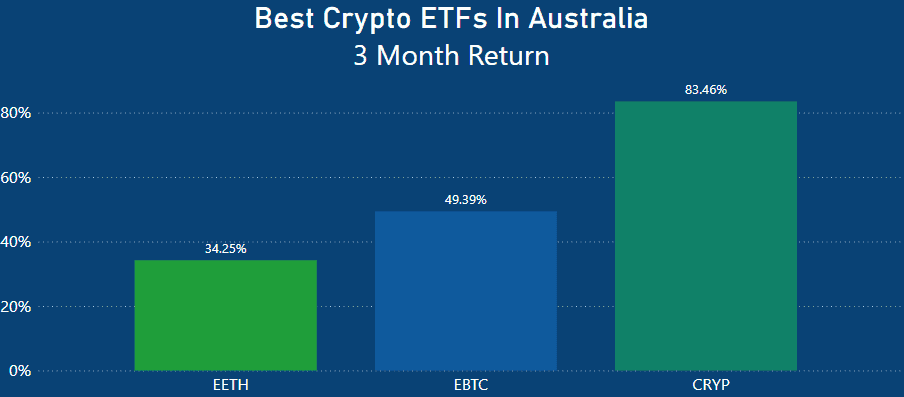

CRYP has exhibited the best 3-month performance among all the ETFs. It returned 8.46% in the past 3 months, surpassing the next best performer, EBTC, which returned 49.39%.

EETH returned 34.25% in the same period, which is over a third less. For those interested, the 3-month total return on the ASX 200 was 8.40% in that same time frame [4].

Crypto ETF Performance – YTD/ 12 Months

As this article is being written on the last day of the year, the YTD and 12-month performance data are the same.

CRYP returned the best result of 252.65% in their YTD and 12-month performance. This was followed, some way behind, by EBTC, returning 152.87% with its bitcoin-focused investments.

EETH, with its Ethereum-focused investment, delivered a 93.75% YTD performance. For context, the ASX 200 delivered a 12.42% return YTD/12 months in 2023 [4], following a strong rally in December.

Crypto ETF Performance Since Inception

With eye-watering figures like 252.65%, rivaled only by the likes of Nvidia with an amazing 245.94% return [5], what has the performance been like for these ETFs since they were first introduced to the market?

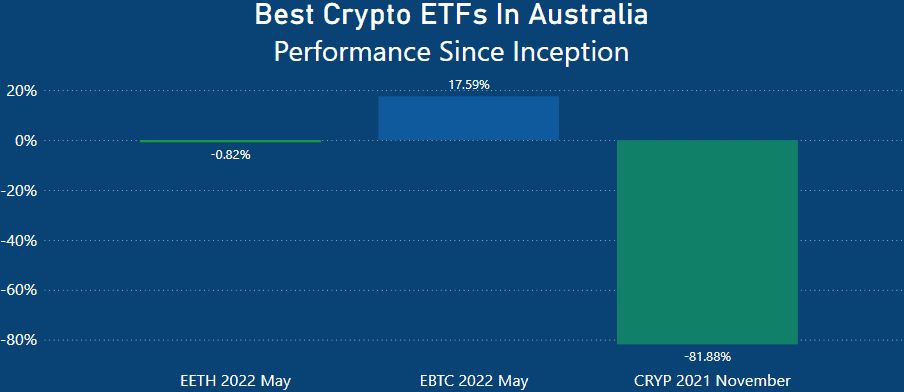

The performances since inception are not as favorable as the chart shown before. CRYP, which had an amazing 252.65% YTD return in 2023, is actually down -81.88% since its inception in November 2021.

EBTC, which returned a dizzying performance of 152.87% in 2023, is up 17.59% since its inception in May 2022. Similarly, EETH, which returned a ‘modest’ 93.75%, is down 0.2% since its May 2022 introduction.

This illustrates the very nature of Crypto ETF investing and the extreme highs and lows they bring.

Summary – Are Crypto ETFs Worth The Risk?

Determining if crypto investing is suitable for you is a highly personal decision, often influenced by your own beliefs about the crypto market and ideology as a whole. Crypto markets have proven to be very volatile.

The movers and shakers in the market aren’t always based on tangible factors, and tweets by figures like Elon Musk can significantly impact prices, driving them sky-high. The very nature of these currencies means they are influenced by outside forces, typical of more established and traditional ETFs.

Deciding whether to invest your money in crypto is a real personal decision, and with that decision, you have to acknowledge the inherent risks involved, as exemplified by the performance of CRYP.

Looking at the year-to-date results, you might regret ‘missing out’ on that growth this year. However, if you were the unfortunate soul to invest at launch, you would be down nearly 89%.

So, if you can stomach the risk, there is a crypto ETF for you.

This article does not serve as an endorsement or recommendation for products mentioned in the article. The information presented here is based on referenced sources and is accurate as of the date of December 30, 2023. Please note that these articles are written sometime before their publication date.

The information provided in this content is for informational purposes only and should not be considered as financial, investment, or professional advice. We recommend consulting with a qualified expert or conducting your own research before making any financial decisions.

The accuracy, completeness, or reliability of the information cannot be guaranteed, and the provider shall not be held responsible for any actions taken based on the information contained in this content.

-

- https://www.betashares.com.au/fund/crypto-innovators-etf/

- https://moneysmart.gov.au/glossary/cboe-australia-cxa

- https://www.investopedia.com/news/largest-cryptocurrency-hacks-so-far-year/

- https://www.spglobal.com/spdji/en/indices/equity/sp-asx-200/#overview

- https://www.google.com/finance/quote/NVDA:NASDAQ?hl=en&window=1Y